AI Decision Platform

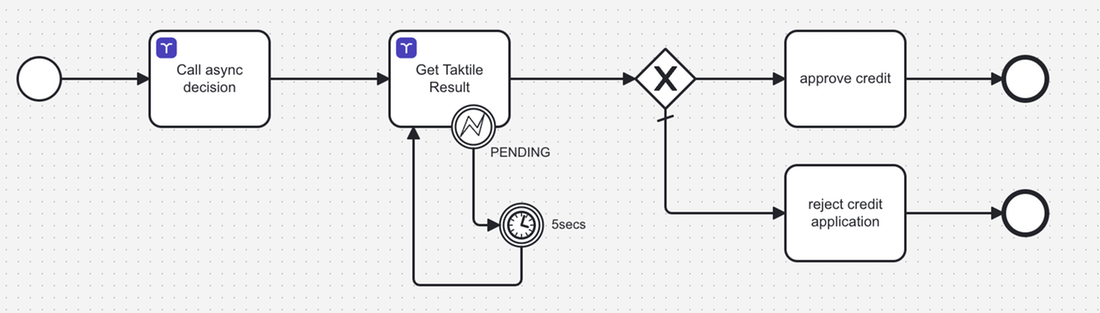

Taktile's AI Decision Platform enables financial institutions to design, test, and deploy automated risk strategies with unmatched speed and usability. Non-technical teams can iterate on decision-making strategies in real time, continuously improving outcomes across underwriting, onboarding, fraud, collections, and more. Through a marketplace of third-party data sources, which are typically costly and complex to build in-house, teams can also instantly enrich decisions with new signals and adapt to change faster than ever. With the Taktile connector, enterprises gain a simple way to weave adaptive decision-making directly into their most critical workflows – reducing engineering overhead while giving business teams the agility to iterate and act on insights in real time. Camunda and Taktile share a mission to help financial services organizations push the boundaries of innovation at scale. By uniting enterprise orchestration with advanced decision-making, they enable teams to eliminate manual effort, accelerate iteration, and build smarter, more adaptive operations across the business.

Features and Benefits

Advanced decision-making across the customer lifecycle

Level up complex use cases

Why this matters for Camunda customers

Details

- Marketplace release date -

- Last Github commit -

-

Associated Product Group Categories:

- Automation Services

-

Version Compatibility:

-

Used resources: